09.15.2021

The August Market in Review

Market Stats

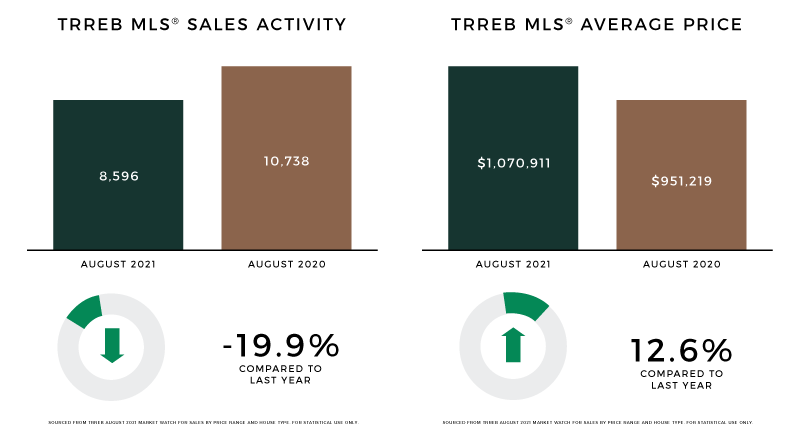

The Toronto Regional Real Estate Board (TRREB) reported 8,596 sales through the MLS® for the month of August compared to 10,738 in August 2020. Year-over-year this is reduced by almost 20 per cent and also lower than July’s reported 9,390 sales.

High demand from buyers and record-low inventory has also caused continued price increases. In August, the average home price was $1,070,911, representing a 12.6 per cent increase over the previous year’s $951,219 average price. However, it is notable that this figure has actually slightly fallen month-over-month since July 2021, which reported an average price of $1,089,536.

Notably, new listings in the area fell 43 per cent from 18,599 in August 2020 to 10,609 in August 2021. TRREB president Kevin Crigger says the fact that listings were at their lowest level for the past decade is “alarming.”

“It is clear that the supply of homes is not keeping pace with demand, and this situation will become worse once immigration into Canada resumes,” he said.

With the upcoming federal election, all of the major parties have made housing supply and affordability a focal point of their platforms. Crigger says that solving supply-related issues is a much better strategy than interfering with “demand-side policies” in improving housing affordability for Canadians going forward.

A Closer Look at the Condo Market

Once again, the condo sector is on the rise, perhaps signaling a reversal of the “flight to the suburbs” trend that was seen during the early pandemic months. With 2,544 reported condo sales last month, there was an 11.3 per cent increase over August 2020. However, this is slightly down over July’s reported 2,614 sales.

Condo prices in Toronto increased by 9.4 per cent over August 2020 at $688,568. This figure is slightly up month-over-month compared to July’s average price of $674,490.

We are seeing continued momentum in the condo segment, perhaps as a result of the affordability issues with single-family homes, and as a result, leasing activity is also up over last year. However, the market is continuing to tighten, resulting in more competition, higher prices, and a squeeze in rent prices too, which were up 3.6 per cent over last month alone.

What to expect going forward

Experts are predicting that the market will continue to favour sellers going into 2022. Although we expect to see a drastic rise in inventory for the busy fall market as sellers come back from their summer holidays, demand will still greatly outpace the supply.

If you’re thinking about selling or buying, I can help create a successful sales strategy that will ensure the best possible outcome. And for buyers and investors, I can help guide you through these tight market conditions for a successful transaction. Contact me today to learn more.